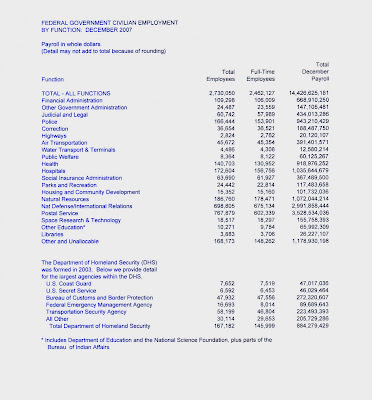

Every added employee to the Federal payroll means one less person that is shouldering the load with the rest of us. By December of 2007 there were 2,462,127 full time civilian federal employees. Of course, some of them are necessary, but as our government grows, so does the burden on the non-government employees. The non-government employees put money into the treasury, not the federal employees. It is not partisan politics, but simple math; growing the government means that the government needs to take in more money from fewer people.

Surprisingly, the Postal Service hires more civilians than the military. But the Military budget out strips everybody, consuming 4.1% of GDP. But when the military is included as Federal Employees, the total of government employees comes to 3,906,680. That’s a lot of people living off of the taxpaying private sector.

Please note, I am not making any judgments about what is and is not needed. These are only numbers to demonstrate the folly of increasing the size of our government in relation to the jobs available in the private sector. It is a mathematical certainty that as public civilian employment rises, so will the demands on a shrinking taxpayer base. The real problems will start when the private sector will no longer be able to keep up with the public sector demands. If we tax our private sector too hard, the whole system will collapse. We as a nation need business owners and the wealth creators to thrive for the sake of the rest of us. The quest for rewards drives our economy. Remove life's rewards with taxation and we lose the incentive that creates economic activity. Already, high taxes have been instrumental in ruining our manufacturing base. Businessmen have been forced to take their businesses to foreign countries. You can guess who has to shoulder the expense of losing good paying jobs.

As quoted from Ronald Reagan, "The Government is not the solution, it is the problem."

As I write this piece, the obscene recovery package is before the Senate. It is for so much money that just to imagine a trillion dollars boggles the mind. If you were to count 24 hours a day, it would take you better than 30,000 years to count to a trillion. Government projects will not provide a lasting recovery. Yes, there will be a burst of activity around each project, but when the money runs out, that activity will cease. The saddest part about it is that we do not have the money. We will have either to borrow it or just print it. We devalue our money when goods and services do not follow the money supply. The devaluation of our money is called 'inflation'.

Scary Stuff,

Check out what the rest of us are having to support with our taxes.

Cheers,

-Robert-

The Military:

Active personnel 1,444,553 (ranked 2nd)

Reserve personnel 1,458,500

Expenditures Budget $583 billion (FY08)(ranked 1st)

Percent of GDP 4.04 (2007 est.)

Federal Civilian Employment:

http://ftp2.census.gov/govs/apes/07fedfun.pdf

Click to Enlarge

No comments:

Post a Comment

Please Include First Name and Town. -Thanks-